This post is part 2 of a seven-part series on The State of AI, 2025. (Part 1)

This second part naturally follows the first part, both in numbering and theme: if the optimal scale-efficiency trade-off is suddenly unclear, then the question of “How much should I invest in GPUs and infrastructure to build new AI models vs. talent that knows how to optimize what I already have?” becomes fundamental. More so when your trusted hyperscaler got the news: “Hey, those DeepSeek guys, how are they doing this so cost-efficiently?”

Try answering that with a folder that says “Project Stargate—expected CapEx: $500 billion” tucked under your arm.

That’s DeepSeek’s real threat. I’d be sorry to mention them so much lately but their prowess is something to behold—and fear if you’re a competitor. It raises questions that US labs don’t want raised: how much can you do by tinkering on a couple of thousand GPUs? Is that enough to achieve AGI? Then, why do you need millions of GPUs in a single cluster? Won’t those over-stacked GPUs go underused?

Or my favorite: Why are you sending your negative profits to Nvidia every trimester in a golden envelope? It’s rather unclear.

When you’re unsure if a technology is worth so much CapEx, one option is to look at productivity, economic growth, and development indices (e.g., real Gross Domestic Product, GDP; Total Factor Productivity, TFP; and Human Development Index, HDI).

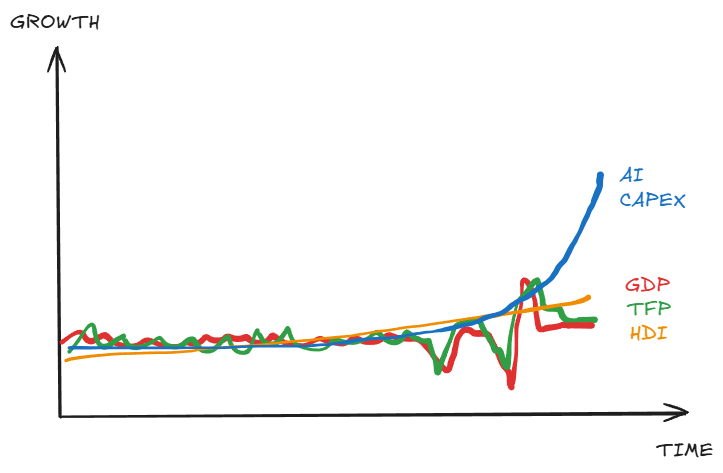

AI might cost a lot but if it grows the economy and improves human wellbeing accordingly then it’s worth it. Well, not if the graph looks like this:

This simplistic graph with unscaled axes is intended to illustrate how AI CapEx (capital expenditures) has been growing without apparent correlation to broadly accepted productivity, growth, and development indices. The disconnection between AI spending and AI impacting is so absent that it’d be funny if it wasn’t tragic.

The actual curves of AI CapEx, real GDP growth, TFP, and HDI don’t look exactly like I drew them (see below) but the trend is clear: the world is growing at the same rate it’s grown for decades. The recent billionaire investments in AI infrastructure and startups have not changed that.

(The valley-peak dyad at the end of GDP and TFP curves is a reflection of the COVID pandemic and the previous valley the consequence of the 2008 financial crisis.)

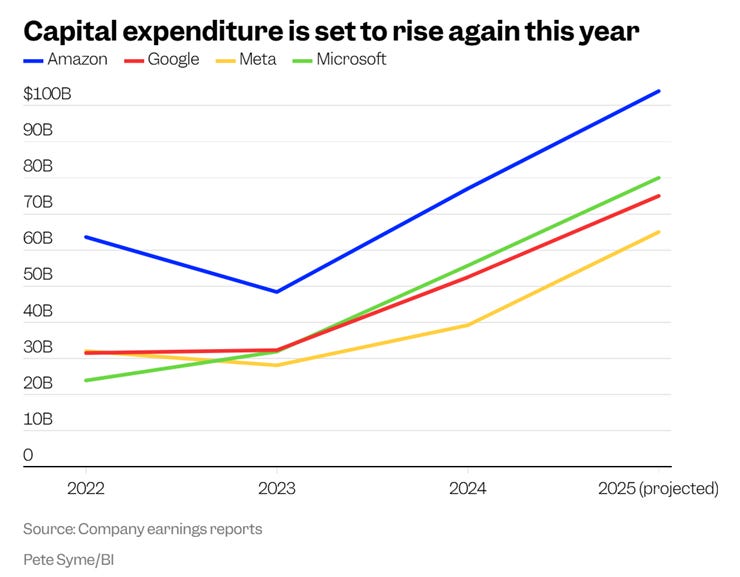

Here are the real graphs for reference (for obvious reasons I couldn’t find an AI CapEx graph before 2022 when ChatGPT kicked off the generative AI frenzy):

The economist published a great piece in July 2024 going in-depth on this question: “What happened to the artificial intelligence revolution?” To my knowledge, no one has debunked the claims nor have the graphs changed much since (we’ll have to wait years to have reliable data on most growth and development metrics, though).

AI remains a powerful technology in search of a reliable way to enhance our collective productivity and grow the economy. GDP, TFP, and HDI scores remain as unfazed by the modern strain of AI models as the farmers and the factory workers that unwittingly sustain the burden of AI CEOs’ unfulfilled hopes.

The state of AI reminds me of the “diminishing returns” story all over again.